We discuss the following topics in this blog:

- Digitisation bringing in the new age of connectivity.

- 5G brings a host of improvements over its predecessor, 4G

- 5G redefining banking from the inside out.

In addition to these topics, we shall also be answering the following FAQs:

- What is WiFi?

- What is 5G NR?

Contents

- 1 Overview

- 2 Is 5G the Tremendous Opportunity for Banks Needed?

- 2.1 1. Digital banking experience will be all about speed and instant gratification

- 2.2 2. Banks will have technological capabilities straight out of sci-fi

- 2.3 3. Banks will send you more hyper-personalized offers and advice

- 2.4 4. The customer service of old will no longer exist

- 2.5 5. Pop-up mobile branches will make banking location-agnostic

- 2.6 6. There will be no need for a physical wallet anymore

- 2.7 7. Purchasing big-ticket items will be as quick and seamless as grocery shopping

- 2.8 8. Fraud prevention and transaction security will immediately improve

- 2.9 9. Banking penetration in rural and backward regions will improve

- 3 FAQs

Overview

With digitalization touching every aspect of our lives in the 21st century, banking for both customers and financial service providers has continued to explicitly shift from a brick-and-mortar experience to the devices we own. Today, all it takes is one tap on the smartphone screen to carry out transactions, pay bills or view the latest statement. Records are now being managed through sophisticated online systems and KYCs are being carried out digitally.

But this is merely the tip of the iceberg. As the new age of connectivity lifts off on the back of 5G, the digital transformation of banks will completely reinvent the process for the better.

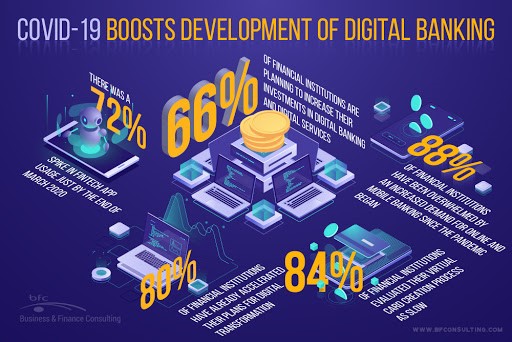

The COVID-19 pandemic has been one of the factors that have accelerated the digitalization of banks – a stepping stone for 5G adoption

Source: bfconsulting

Is 5G the Tremendous Opportunity for Banks Needed?

First, let’s quickly take a look at how 5G networks will send us to the promised land of futuristic connectivity and evolution of banking.

As a next-gen mobile communication service, 5G brings a host of improvements over its predecessor, 4G. The three most important ones are:

- Higher Speed: 5G is 10 to 100 times faster than 4G. This means that heavy data transfer can occur over digital networks within the blink of an eye.

- Lower Latency: 5G is much more responsive than 4G as it brings down latency time to under 1 millisecond.

- Enhanced Connectivity: With 5G, new possibilities in connectivity will be achieved, especially through the Internet of Things. This will mean more smart devices in the world that are connected both to the internet and each other in real-time.

By 2025, there will be over 2.8 billion 5G subscriptions in the world. With superfast digital connectivity a new normal, consumers will begin to demand the same from their banking experience. This is where banks will also harp on the 5G bandwagon to improve the speed of digital transformation, enhance the customer experience, explore new revenue streams and achieve greater cost efficiency. 5G’s use cases in IoT, streaming, big data, AI and more are bound to be implemented at a radical pace in the banking ecosystem to change it forever.

So, how will this banking evolution look like, now that we have the future of 5G within our grasp? We gazed into our crystal ball and this is what we saw.

1. Digital banking experience will be all about speed and instant gratification

Thanks to the lightning-fast speeds, almost zero latency and high bandwidth, 5G networks will enable banks to upgrade their apps and websites for more efficiency. This seamlessness will also be a result of banking data being now stored on the cloud. Payments will be simpler and faster, fuelling further adoption of digital payments by customers and merchants. Transactions won’t be slowed down due to lack of bandwidth or heavy traffic on the bank’s channels. Additionally, banks may look to create a more connected omni-channel experience by extending services to wearables, VR devices and IoT devices, in turn leading to the creation of more personalized services.

2. Banks will have technological capabilities straight out of sci-fi

With 5G, ‘smart banks’ will emerge as new hubs of tech innovation. Instant facial recognition, VR/AR banking, pattern recognition for augmented computing power, footfall analysis, etc. will improve the brick-and-mortar bank experience. ATMs will become thin clients, offering AI-backed personalized financial services in an instant.

Source: World Economic Forum

3. Banks will send you more hyper-personalized offers and advice

Thanks to 5G’s immaculate data transfer capabilities, banks will be able to deploy AI and machine learning to shift through ever-increasing consumer data, both behavioural and financial, made available through an increasing number of connected devices with transactional capabilities. This will allow banks to target consumers with hyper-contextualized advice and better product and loan recommendations.

4. The customer service of old will no longer exist

The future of 5G powered customer services for banks will no longer simply have human customer care personnel on the other end of the line. Thanks to high resolution streaming on 5G networks, video consultations with financial representatives via video calls will become the norm. Issues will be instantly resolved thanks to AI and machine learning equipped customer ‘bots’, making the whole process automated, time-efficient and highly personalized.

5. Pop-up mobile branches will make banking location-agnostic

Through 5G, banks will now have the means to expand their footprint and reach without building any physical branches. Portable, pop-up mobile branches that provide a completely authentic banking experience through VR, etc. will be a boon for remote locations. 5G-enabled self-serving banking kiosks that provide instantaneous support from main branches can be set up at events such as music festivals, or in a disaster-affected area where banking services have taken a hit.

6. There will be no need for a physical wallet anymore

We’re already witnessing a shift in payment behaviour across the world, with digital payments and wallets rising in popularity. As per the 2019 Performance Against Customer Expectations survey by FIS, almost 20% senior millennials have completely switched to mobile payments. This trend will further pick up pace thanks to 5G’s high-speed transaction capabilities, so much so that people will stop using physical currency. As more and more wearables and IoT devices such as smartwatches enable people to transact, digital wallets across channels will become even more lucrative – offering special offers, rewards and value-added innovations to the customer.

7. Purchasing big-ticket items will be as quick and seamless as grocery shopping

At the end of, 5G’s next-gen communication network means high-speed, real-time data flow. This will enable financial institutions to streamline time-consuming, multi-step, big-ticket purchases such as securing a loan or buying a vehicle, making them almost instantaneous! AI-equipped banking tools will emerge that comb through personal data to optimize offers and interest rates for each applicant.

8. Fraud prevention and transaction security will immediately improve

One of the most important aspects of the banking industry’s 5G evolution will be real-time fraud detection and repair of security flaws across apps, websites, wearables and payment gateways without any downtime for the customer. Authenticating merchant identity, transaction amount, geolocation, etc. will be done in the blink of an eye. Biometric authentication will be augmented with multiple other security processes such as facial recognition, geo-location and more – thanks to 5G networks providing high speed and low latency. Moreover, by supporting blockchain and DLT (Distributed Ledger Technology), 5G will boost trust in digital transactions and encourage ‘smart contracts’ between businesses – a financial agreement fulfilled upon meeting certain criteria.

9. Banking penetration in rural and backward regions will improve

The future of 5G in banking will empower much-needed financial inclusion for rural and remote populations across the world. While not everyone has access to a physical bank, everyone certainly will have a smart device powered by 5G in the coming decade. This will give banks an unprecedented opportunity to reach out to more customers through a seamless, simplified digital banking interface – either through phones, laptops or kiosks. 5G will also enable real-time translation so that everyone can enjoy innovative financial applications natively.

It’s been a long time since banks overhauled their systems and processes to match rising customer expectations and advancements in next-gen communication networks. As 5G begins to go mainstream worldwide in the coming years, banks must be ready to grasp an opportunity to transform the industry forever. So far, the signs indeed look promising.

FAQs

What is WiFi?

Put simply, WiFi is a technology that uses radio waves to create a wireless network through which devices like mobile phones, computers, printers, etc., connect to the internet. A wireless router is needed to establish a WiFi hotspot that people in its vicinity may use to access internet services. You’re sure to have encountered such a WiFi hotspot in houses, offices, restaurants, etc.

To get a little more technical, WiFi works by enabling a Wireless Local Area Network or WLAN that allows devices connected to it to exchange signals with the internet via a router. The frequencies of these signals are either 2.4 GHz or 5 GHz bandwidths. These frequencies are much higher than those transmitted to or by radios, mobile phones, and televisions since WiFi signals need to carry significantly higher amounts of data. The networking standards are variants of 802.11, of which there are several (802.11a, 802.11b, 801.11g, etc.).

What is 5G NR?

5G typically refers to the fifth generation of wireless technology. NR, commonly known as New Radio, is a standard developed by the 3GPP Group (Release 15 being the first version introduced back in 2018) outlining the technology required to harness the newly-available millimeter-wave frequencies. The two frequency bands in which 5GNR operates are Frequency Range 1, i.e., Sub 6GHz band (410 MHz to 7125 MHz), and Frequency Range 2, i.e., millimeter-wave (24.25 to 52.6 GHz). Over 4G LTE, 5G NR provides better spectrum utilization, faster data rates, hardware efficiency, and improved signal processing.

From a deployment standpoint, we have Non-Standalone Mode(NSA), Dynamic Spectrum Sharing(DSS), and Standalone Mode (SA). The initial deployments of 5G NR are based on NSA standards, meaning the existing 4G LTE network will operate on the control plane, and 5G NR will be introduced to the user plane. This particular standard was introduced by 3GPP, keeping in mind the industry’s push to faster 5G services rollout while utilizing the existing 4G LTE infrastructure currently in place. On the other hand, operators are also implementing Dynamic Spectrum Sharing (DSS) to accelerate the deployment cycle, reducing costs and improving spectrum utilization. In this standard, the same spectrum is shared between the 5G NR and 4G LTE, multiplexing over time per user demands. Lastly, we have the Standalone Mode (SA), which moves towards a complete 5G based network where both signaling and the information transfer are driven by a 5G cell.

In the future, 5G will enable new services, connect new industries and devices, empower new experiences, and much more, providing mission-critical services, enhanced mobile broadband, and various other things.

a) Enhanced mobile broadband (eMBB) Applications: High device connectivity, High mobile data rates, and Mobile AR & VR applications

b) Ultra-reliable, low-latency communications (uRLLC)Applications: Autonomous vehicles, Drones, Data monitoring, Smart mfg.

c) Massive machine-type communications (mMTC)Applications: Healthcare, Industry 4.0, Logistics, Environmental monitoring, Smart farming, Smart grids