We discuss the following topics in this blog:

- How Platformication Plays a Major Role?

- Chicken & Egg Problem

- How to Decode Complex Purchasing and Delivery Path?

In addition to these topics, we shall also be answering the following FAQs:

- What is WiFi?

- What is IoT?

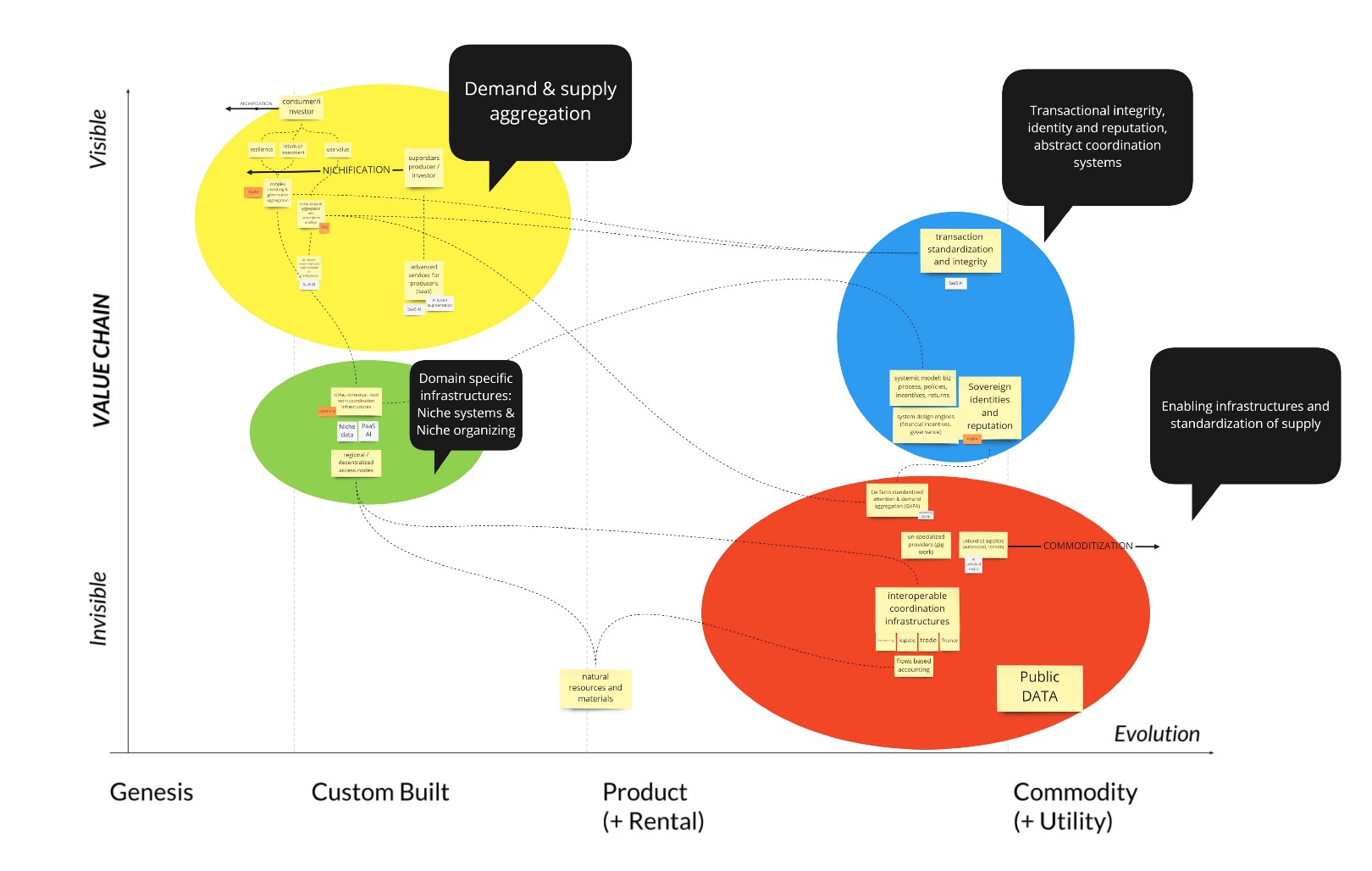

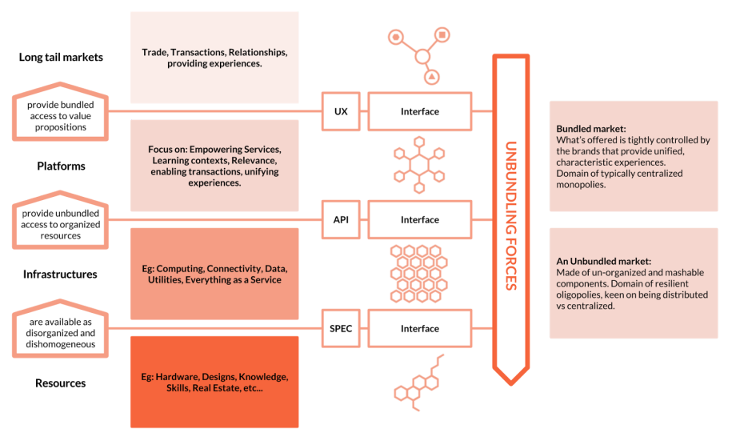

Source: Platform Design Toolkit by Cicero

Contents

How Platformication Plays a Major Role?

The weight of incumbency along with the competitive necessities would lead to eventual but faster deployment of 5G, WiFi 6, and Open vRAN. While these low-hanging fruits are being plucked, it is the Platformification that will catapult Operators into the “age of now” membership economy.

However, all of us have this innate ability to tell apart what is fundamental from what is merely incidental. This applies to the whole Platform mania among the Telcos as well. Platforms in non-Telco sectors are failing at an alarming rate. So, it is particularly important to comprehend whether platformification is an afterthought or an inducted strategy in order to flip the odds for Telcos.

Telcos can avoid the obvious mistakes by identifying the sources of platform failures in other sectors. And here is an interesting excerpt from HBR More Than 250 Platforms Reveals Why Most Fail:

To understand why and how platforms fail, we tried to identify as many failed American platforms as possible over the last twenty years that competed with the 43 successful platforms. The 209 failures allowed us to extract some general lessons about why platforms struggle. In general, platforms fail for four reasons:

(1) mispricing on one side of the market,

(2) failure to develop trust with users and partners,

(3) prematurely dismissing the competition, and

(4) entering too late.

On a closer look, you would realize these reasons do apply to the non-platform business as well. So we zeroed in on the B2B platforms and discovered very fundamental problems for enterprise platforms:

Chicken & Egg Problem

Simply put, who would you get first onto the platform? It is

a problem of getting partners, vendors and customers onto the platform and

scaling them up to the critical mass to get that flywheel effect. Why should a

willing partner or a vendor show up, if the demand side doesn’t already exist?

On the contrary, why would the customers come and trust their money for the

un-validated promises of the platform.

The problem can be decomposed into

- Cold Start (Seeding)

- Mutual Baiting

- Critical Mass

- Double Company

Seeding a platform from zero to network effect is very complicated. The cold-start problem is the key challenge that every platform or a multi-sided marketplace has had to overcome. The latent heat of steam is required to spark the virtuous engine into motion. We need to subsidize and seduce one or both sides (mutual baiting) of their marketplaces with cash and promise in order to get the flywheel started.

This problem squarely fits into the common objection raised against the Platformification of Telcos: Isn’t it an easy bet for Amazon or Apple to add Telco services to their already successful platforms rather than Telcos becoming platforms (mimicking Apples or Amazons) and trying to crack the market??

The answer is two-fold:

Unlike Amazon or Facebook, CSPs are telco-native and these services are not vertical adjuncts. So customers tend to benefit more from the masters of the domain.

The second point is, fortunately, CSPs do not have to deal with the chicken and egg problem. Because they already have customers, vendors and partners – all they are doing is bringing them on to the common platform which is open and democratic. Without vendor lock-in, thanks to ORAN Alliance, this should be easier.

How to Decode Complex Purchasing and Delivery Path?

Selling and buying is super complicated on the enterprise sides of things. Highly specific customizations, region-specific regulations and taxation along with opaque payment and settlement cycles make it challenging for B2B marketplaces. Also, between co-innovation on the platform and getting a solution live, there is a significant component of billable activities that are off-platform, which needs to be taken care of.

Experience is central to any platform. And solving for frictionless journeys for Partners, Vendors and Customers is like running three companies at the same time. Unless and until the driving technology behind the transformation is highly nuanced and reliable, platform games are going to be super tough.

Acknowledging the unique dynamics of individual market segments, STL has built dTelco for Retail and dEnterprise for Enterprise specifically. Nevertheless, both of them are powered by Partners and Marketplace capabilities to scale their partner ecosystems effectively right from acquisition, onboarding, compliance, settlement, management and retention. Also providing an integrated suite of services for partners to make every moment across the partner lifecycle journey seamless. Attention to detail and depth of thought is what sets great solutions apart from average ones. Telcos would appreciate that in STL’s platform solutions when they create edge cases. Here is a cool whitepaper for more details into our obsession with Platforms and Marketplaces.

FAQs

What is WiFi?

Put simply, WiFi is a technology that uses radio waves to create a wireless network through which devices like mobile phones, computers, printers, etc., connect to the internet. A wireless router is needed to establish a WiFi hotspot that people in its vicinity may use to access internet services. You’re sure to have encountered such a WiFi hotspot in houses, offices, restaurants, etc.

To get a little more technical, WiFi works by enabling a Wireless Local Area Network or WLAN that allows devices connected to it to exchange signals with the internet via a router. The frequencies of these signals are either 2.4 GHz or 5 GHz bandwidths. These frequencies are much higher than those transmitted to or by radios, mobile phones, and televisions since WiFi signals need to carry significantly higher amounts of data. The networking standards are variants of 802.11, of which there are several (802.11a, 802.11b, 801.11g, etc.).

What is IoT?

IoT or Internet of Things refers to a network of physical devices (embedded with intelligence and technologies) connected to the internet to share and collect information. The term Internet of Things was first coined by British technology pioneer Kevin Aston in 1999. The rise to IoT has been mainlyImagee to the following reasons: access to low-cost, low-power sensor technology; ubiquitous connectivity, Cloud computing platforms, Machine learning & analytics, and Conversational artificial intelligence (AI).

In a typical IoT environment, data is collected via smart sensors (like GPS, Accelerometer, Camera, temperature sensor, etc.), i.e., it could be as simple as taking temperature data from the surrounding. Next, the data is sent to the cloud. The sensors could be connected to the cloud via Satellite/ WiFi/ Bluetooth/ Cellular/Ethernet. As the data reaches the cloud, it undergoes data processing and analytics. Once the data is aligned to the specific use case, it can be sent to the user device of choice, laptop/computer via email/text/notification, etc. When IoT devices talk to each other, they can use various standards and protocols, for example, WiFi, Bluetooth, ZigBee, Message Queuing Telemetry Transport (MQTT), etc.

With the potential of converting any physical device into an IoT-powered device and negate the need for human intervention, the technology is set to transform across every possible sector. The major industries that will benefit from IoT will be:

a) Manufacturing (Quality Control, Predictive Maintenance, Smart Packaging, etc.

b) Automotive (Fleet & Driver Management, Real-Time Vehicle Telematics, IoT based Predictive, In-vehicle Infotainment maintenance, etc.)

c) Transporation and Logistics (Inventory tracking and warehousing, Location management systems, Drone-based delivery, etc.)

d) Retail (Automated Checkout, In-store Layout Optimization, Robot Employees, etc.)

e) Finance (Auto Insurance, IoT enabled Smart Payment Contracts, Account Management)

f) Healthcare (Remote patient monitoring, robotic surgeries, Ingestible sensors, etc.)

g) Public Sector ( Infrastructure management, Disaster management, Law enforcement)